Course Content

Course Content

4 Chapter • 23 Lessons

Introduction to Investment Banking | Business verticals of Investment Banks | Investment Banking Division | Global Markets Division | Types of Financial Markets, Different Market Participants & Regulatory Agencies | Buy Side vs Sell side | Asset Management Introduction | Research Introduction

Stock Market Basics | Equity Securities | Global Stock Indices & Exchanges| Equity vs Preference Shares | Dividends & Corporate Actions | Depository Receipts – ADR & GDR | Primary & Secondary Markets | Issuance/Trading | IPO Process – US & Indian Markets | Global Financial Centres & Trading | Trading Mechanics | Stock-picking: Selecting fundamentally good stocks | Sectoral Analysis | Ranking stocks in a sector

Fixed Income Basics | Types of Fixed Income Products | Yield & Yield Curve| Relation Between Interest Rate & Bond Price| Bond Pricing & Valuation | Optionality in Bonds – Callable vs Puttable| Clean price, Dirty Price, Accrued Interest | Measuring Interest Rate Risk | Duration & Convexity in a Bond | Bond spreads & OAS | Bond Portfolio | Credit Ratings | Securitization & products: MBS & ABS

Introduction to Money Markets | Difference between Capital & Money Markets | Instruments of Money Market | T-Bills, Certificate of Deposit, Commercial Paper, Repo, Reverse Repo & others| Conventions in Money Markets | Valuation of Money Market Instruments | Advantages & Disadvantages of Money Markets

FX Basics & Markets| Types of Quotations | FX Products | Difference Between FX & Futures | Type of FX Trade – Cash, Spot, Tomm, NDF, Forward | Trade Economics of FX Transactions | Exchange Rate determinants | Currency Hedging | FX Arbitrage

Derivatives – An Introduction | Difference between OTC & ET Derivatives | Forwards Contracts, Futures Contract | Valuation of Forwards & Futures contracts | Margins in Futures & Settlement | Futures & Forwards Payoffs | Definition of Options | Types of Options | Types of Option Payoffs | Options Pricing | Introduction to Swaps | Interest Rate Swap & mechanics| Valuation of IRS | FX Swap & mechanics | Credit Default Swap, Credit Events & mechanics | Default Probability Maths | Valuation of Swap Market Conventions

Introduction to Swaps | Interest Rate Swap & mechanics| Valuation of IRS | FX Swap & mechanics | Credit Default Swap, Credit Events & mechanics | Default Probability Mathematics | Valuation of CDS | Basket Swap Products | Swap Market Conventions | CDOs | CDO Tranches| CMOs | Issues in Collateralized products & Credit Crisis

Interest Rate Swap & Hedging/Trading illustrations | FX Swaps & Hedging/Trading illustrations | Equity Swap & Hedging/Trading illustrations | Credit Default Swap & Hedging/Trading illustrations | Settlement Process of Swaps | Duration of Swaps | Hedging Ratios in Swaps | Hedging a Bond Portfolio with Swaps

What is Corporate Actions | Purpose of Corporate Action | Types of Corporate Actions | Dividends & types – cash, SCRIP, DRIP | Bonus Issues | Rights | Stock Splits & Reverse Splits| Mergers, Demergers & Liquidations | Takeover & Exchanges | Convertible Bonds | Important Dates in Corporate Actions | Trade life Cycle in Corporate Action Events

Structure of Front office, Middle office & Bank office | Overview of Trade Lifecycle | Participants involved in Trade Lifecycle | Trade Initiation & Order Placement | Order Routing and Execution | Trade Confirmation | Post-trade Processing | Clearing and Settlement | Trade Reconciliation | Trade Reporting

Custodial Services | Depositories | STP, FIX Protocol, SWIFT | Payment Systems | FZ Settlement | Failed Settlement | Safekeeping | Nominees | Cash Management | Securities Lending | Transfer Agency | NAV Calculations | Taxation

Definition | Position within the TLC | Different Types of Reconciliations: Nostro, Depot, Trade, Exchange, Static Data, Intra, & Inter Recon | Life cycle of Typical Reconciliation Process | Risks Addressed by Reconciliation | Integrity of the Reconciliation Framework

Introduction to Reference Data Management | Securities Identification Numbers | Static Data | SWIFT, Markit and others | Instrument Set-up | Investor Set-up | SSI Set-up | Counter Party Identifiers | Other Reference Data Example

ISDA Overview | Role of ISDA | Architecture | Hierarchy | ISDA Master Agreement | Provisions | Schedule | Various ISDA Documents | Derivative Products | ISDA Protocols | Credit Support Annex (CSA) | Confirmations | Best Practices

FATCA | GDPR | MIFID | MAR/MAD | UCITS | BASEL 2/2.5/3 | AML

KYC Process | KYC requirements and procedures| Collecting customer information and verifying identities| Customer Due Diligence (CDD) | Different levels of due diligence based on risk assessment | KYC Documentation | Enhanced Due Diligence (EDD) | Extra measures taken for politically exposed persons (PEPs) and high-risk clients | Source of Funds and Source of Wealth (SOF/SOW) | Customer Identification Program (CIP)

Money Laundering Definition and stages | AML Laws and Regulations | Risk-Based Approach (RBA) | Customer Risk Profiling | Transaction Monitoring and Analysis | Customer Due Diligence (CDD) | Politically Exposed Persons (PEPs) | Trade-Based Money Laundering (TBML) | Terrorist Financing | Suspicious Activity Reports (SARs) | Conducting AML audits and reviews

Principles of Risk Management | International Risk Regulation | Risk Identification and Assessment Framework | Metrics used in Risk Management – Value-at-Risk and Expected Shortfall | Operational Risk | Credit Risk | Market Risk | Value-at-Risk Models | Liquidity Risk | Corporate Governance and Risk Oversight | Model Risk |Enterprise Risk Management (ERM)

Introduction to Collective Investments | Open-Ended Funds | Close-Ended Funds | Tax-Efficient Savings | Mutual Funds | Hedge Funds | Private Equity and Venture Capital Funds | Tax Treatment of Collective Investments | Charges and Pricing of Collective Investments | NAV Calculations | Benchmarking | How Fund Managers pick Stocks

Basic of Excel | Important Excel Formulae | Look-up Functions | Aggregation Functions | Pivot Tables and Charts | Data Validations | Conditional Formatting | Graphs and Illustrations in Excel

Optimization in Excel | Scenario Analysis | Sensitivity Analysis | Advanced Pivots | Power Query Editor and Data Transformation/Cleaning in Excel | Power Pivots | Dashboarding through Excel/PowerBI| Introduction to Macros

Projections in Excel | Valuation Models and Templates in Excel | DCF Modelling | FCFF/FCFE Modelling | Relative Valuation and Multiples | Transaction Multiples

Resume Building | Presentation Skills | Interpersonal Skills | Interview Preparation – Functional & Soft skills | Domain Mock Interviews | HR Mock Interviews

Course Description

Course Description

|

|

|

|

Course Outcomes

Course Outcomes

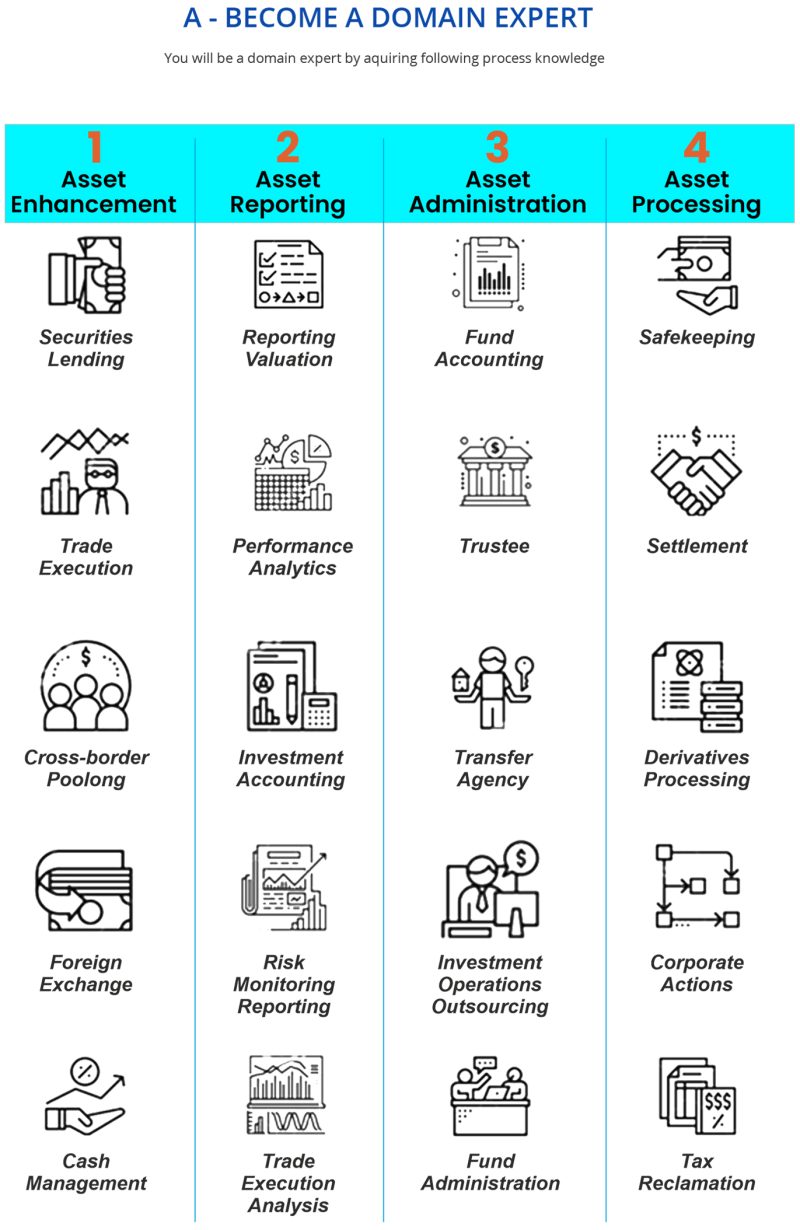

Investment Operations Certificate (IOC) is widely considered as a gold standard in global Investment Banking and Investment Operations and has been approved by 50+ global regulators including UK FCA. IOC Certification would be provided by UK’s Charter body CISI (Chartered Institute for Securities and Investments) and the training is delivered by EduEdgePro.

Many leading Investment Banks and Financial Institutions have mandated the IOC certification globally, as part of their domain requirements. Comprehensive training on IOC certification linked to placements, is exclusively offered by EduEdge Pro in India and globally, through an online 90-hour program comprised of on-demand, self-paced learning.

On successful program completion, participants would be awarded the IOC Certification and the prestigious UK ACSI designation, an important landmark in global Investment Banking Operations, that would considerably enhance your career opportunities by developing industry-relevant domain skills-sets in Investment Banking and Investment Operations.

You will get an in-depth understanding of International Introduction To Securities And Investments, Global Securities Operations, Risk In Financial Services and other important domains within Investment Banking.

Besides, we will also teach you Financial Modelling using Excel, cover important concepts in Capital Markets and help prepare you for interviews in Investment Banking.

You will learn directly from industry experts, market practitioners, and seasoned finance professionals about Investment Banking, Investment Operations, Fund Administration, Financial Markets and Risk Management.

Why is IOC important

IOC is recognized by UK regulator FCA, along with multiple regulators across the world. It has become the gold standard in international Investment Operations. IOC gives you a prestigious UK certificate, your entry door into global institutions and the pathway leads to the ACSI designation.

International qualification

The IOC is taken in over 50 countries, reflecting the global importance of operations and recognized by global regulators in important international financial jurisdictions

Recognized by the UK FCA

IOC features on the Financial Conduct Authority’s Appropriate Qualification Tables as a suitable exam for those in a number of overseeing roles

Career development

Completing the IOC demonstrates professionalism, commitment to working in the industry and offers access to higher-level qualifications

Endorsed by the Financial Skills Partnership

The IOC is listed on the FSP’s Qualifications List

Free CISI Student membership

Become associated with a chartered professional body and take advantage of an extensive range of benefits

ACSI designatory letters

Instructor

Instructor

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Student Feedback

Student Feedback

No Review found